The Wealth Gap

Over the past couple of years there has been a concerted effort throughout society to address issues related to Diversity, Equity & Inclusion (DEI). At Aspasia Wealth Management we feel it is important to address areas where DEI still needs to be improved. Most relevant to us is the inequity in the distribution of wealth. Over the next several months we will attempt to add to that discourse by shedding some light on how the “Wealth Gap” manifests today.

What is the Wealth Gap?

The Wealth Gap (also known as the gap between rich and poor, income inequality, wealth disparity, or wealth and income differences) consists of disparities in the distribution of wealth (accumulated assets) and income.

Is this Wealth Gap real?

The short answer is yes. The Board of Governors of the Federal Reserve System (these are the folks that control the supply of money in the United States) conducted a survey in 2019 to study the disparities in wealth by race and ethnicity in consumer finance. The survey examined a myriad of varied factors, but what is clear is on various distinct levels white families have more wealth than minority families. They detailed these findings under several distinct categories.

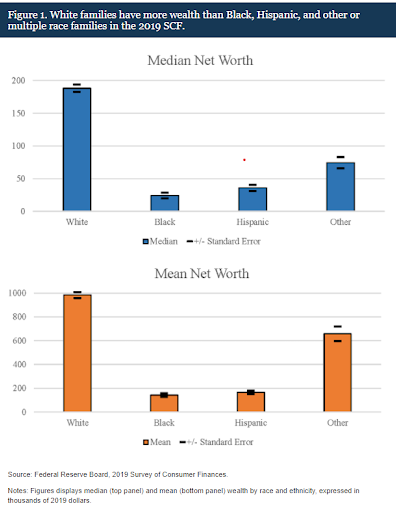

Total family wealth

White families have the highest level of both median and mean family wealth: $188,200 and $983,400, respectively. On the other hand, Black and Hispanic family wealth is less than 15% of White families, at $24,100 and $142,500, respectively.

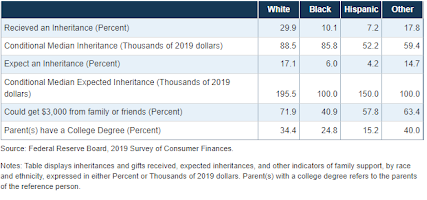

Inheritances and wealth transfer

Many people want the assets that they have earned and saved to be passed to their families and loved ones. Because of this, wealth transfer and inheritance are one of the quickest and most efficient ways that families can generate wealth.

The survey showed that about 30% of white families report having received an inheritance of gift. This is compared to about 10% of Black families and 7% of Hispanic families. When looking only at families who received an inheritance or gift, White families also tend to receive larger inheritances.

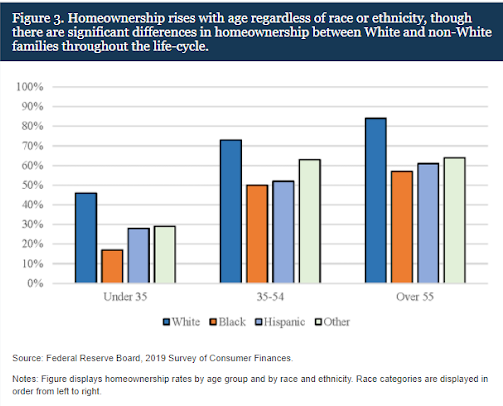

Homeownership

For many families, the most valuable asset that they own is their home. The relationship between housing and family wealth is complicated and ends up being a double-edged sword. On one side, a family looking to purchase a home must already have wealth accumulated to put towards down payments and closing costs. On the other side, homes have historically increased in value and have become a key channel through which families build wealth. When analyzing homeownership rates about 46 percent of White families own their home, compared to just 17 percent of Black families.

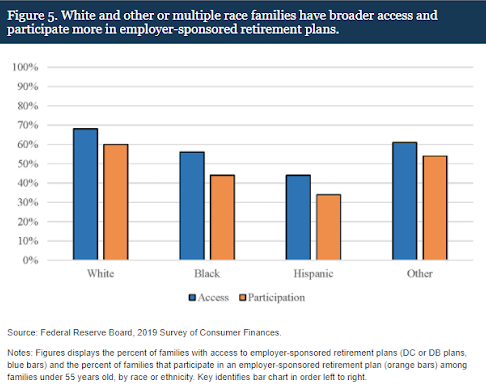

Retirement Accounts

Participating in various retirement accounts can help provide long term financial confidence. These assets include individual retirement accounts (IRAs), which typically are not dependent on a family's employer, and two types of employer-sponsored plans: defined contribution plans (DC), which are account-type job pensions such as 401(k)s, and traditional pensions (defined benefit plans, DB).

Black and Hispanic families are far less likely to have such retirement accounts. For example, among middle-aged families –who have the highest rates of account ownership— 65 percent of White families have at least one retirement account, compared to 44 percent of Black families, and just 28 percent of Hispanic families.

Understandably, the findings of this survey and others like it can illicit emotional response. Our goal in contributing to this discourse is to transcend those emotions and provide actionable solutions that we feel can help close this generational Wealth Gap, especially as it pertains to race and ethnicity.

Personally, the emotions I feel while reading this data are complicated. Half of my family is White while the other half are people of color. This fact combined with the experiences that I have had as a financial professional allows me to have a unique perspective in commenting on these issues. Each month I’ll continue to give my outlook and delve into different topics related to diversity in relation to finance.