Millennials: The Time to Invest is Now

I am a millennial.

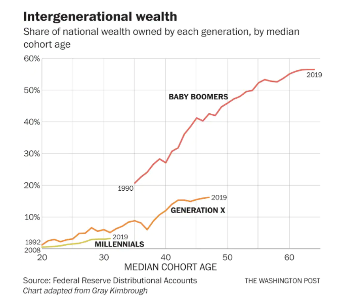

According to the Federal Reserve, relative to members of earlier generations, millennials (usually defined as the generation of people born between the early 1980s and 1990s) are more racially diverse and more educated. Unfortunately, they are also financially worse off in almost every measurable way as they have lower earnings, fewer assets and less overall wealth.

There are many factors that have influenced this disparity. One often talked about is the rise in higher education costs.

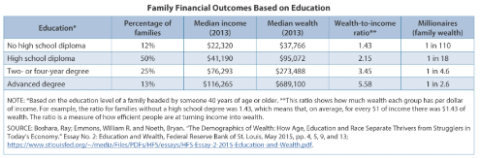

Many Americans are taught to go to college for a good reason: people who earn college degrees earn more income which leads to more wealth.

As the demand for college education has increased, so has the cost. That cost has largely been passed down to students and their families. While education costs have increased, wages have remained largely stagnant. Families seeking higher education for their children are paying a rapidly increasing cost without a significant increase in income. Therefore, many families are forced to resort to taking out student loans.

A millennial with student loan debt is as ubiquitous as peanut butter and jelly. More millennials borrow to pay for college compared to other generations, and the loans are bigger. This means that upon graduation, a significant percentage of millennial earnings must be dedicated to debt payment as opposed to wealth building instruments such as a home or other longer-term investments. This is a key factor in why “millennials are worse off.” While the US stock and housing markets have continued growing at historical levels, millennials have not proportionally shared in that benefit. Because they are unable to contribute as high of a percentage of their income as other generations to these wealth building instruments, they are not reaping the same profits.

However, even with all of these factors (lower earnings, higher debt, etc.), millennials do have a glaring advantage as compared to older investors when it comes to building wealth: TIME. Our generation has decades before retirement for their investments and wealth to compound and grow. Millennials should consult professional financial planners who have the tools and can lend their expertise and make recommendations that will benefit them and their families for years to come. If millennials make the decision now to take control, assess and make a plan, they have time to make a big enough impact to secure their future financial future.