“Equity” in Stocks?

Stocks are how ordinary people invest in some of the most successful companies in the world. Investors own stock to earn a return on their investment, primarily by selling the stock for a price higher than they paid.

Historically, stocks have been one of the best vehicles for growing wealth. Over a long period of time, they have outperformed most other investments. Ironically, stocks, also referred to as equities, are far from equitable when it comes to race and ethnicity. The Federal Reserve’s Survey of Consumer Finance (2019), found that 61% of White families owned stocks in 2019, while only 34% of Black families and 24% of Hispanic families did. With data showing that communities of color have less wealth and earn less income, it is not surprising that these communities would have less in any type of long-term investment vehicle. After all, you need to have money to be able to invest.

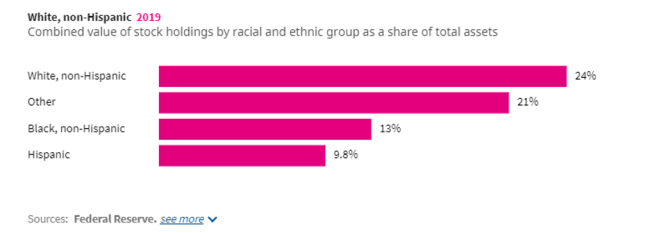

A bit more striking is the data that measures stock ownership as a percentage of wealth. The same Federal Reserve survey showed that 24% of White family assets were in stocks, 13% for Black families and 10% for Hispanic families. This data shows, that while stocks have been growing at historic levels recently, that growth has disproportionately benefitted White families. This illuminates a very troubling concept; as the stock market grows (something that virtually everyone wants to happen) the wealth divide will compound.

https://www.federalreserve.gov/econres/scfindex.htm

So why is this happening? I think there are a few plausible explanations. Communities of color have historically been distrustful of many of our everyday institutions. The distrust of the healthcare system and criminal justice system is well documented. The financial system is no exception. In addition, stocks are inherently riskier than many other investment alternatives. We know that communities of color on average have less wealth, so it makes sense that they would want to take less risk with their money as well.

The solution is a matter of education, specifically financial literacy. The more educated people are about a specific topic, the more likely they are to trust that system and understand how that system can benefit them for generations. In my opinion, the duty of promoting financial literacy falls on the shoulders of people like us, at Aspasia Wealth Management. Financial professionals, who are fiduciaries, that help guide investors to meet their personal and financial goals.

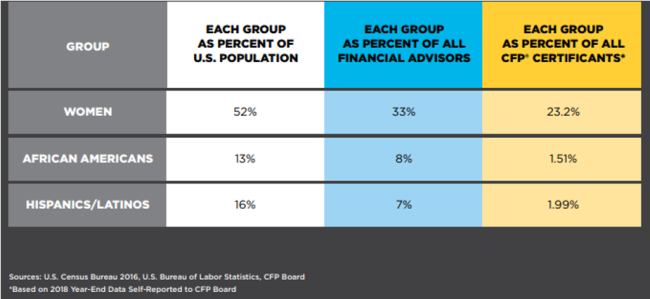

However, communities of color are grossly underserved and underrepresented in this profession. The CFP Board (who issues the CERTIFIED FINANCIAL PLANNER™ designation) claims that their certification is “the standard of excellence in financial planning”. The Board currently has 90,773 certificants. Of that over 90k, there are less than 4,000 Black and Hispanic certificants...combined.

Why does this matter? As a practicing CFP® professional myself, I know that my clients work with me so that I can provide them with recommendations that will result in a tangible economic benefit. I also know that the primary reason my clients listen to my recommendations is because we have built a certain level of trust. While things like investment returns, dividends etc. are important, this “trust” is the bedrock of our relationship. Because for most people, when it really comes down to it, money is emotional.

It’s self-evident that it is easier to trust someone who is part of your community and is therefore more likely to have shared life experiences. The good thing is that the CFP board has made efforts over the past few years to increase diversity in the profession. As that effort continues, hopefully they will be able to engage with financial professionals of color who will be able to serve their respective communities. While that effort persists, it is even more important for professionals currently in the industry to demonstrate intentionality in serving these communities to help combat this current state of wealth inequity.